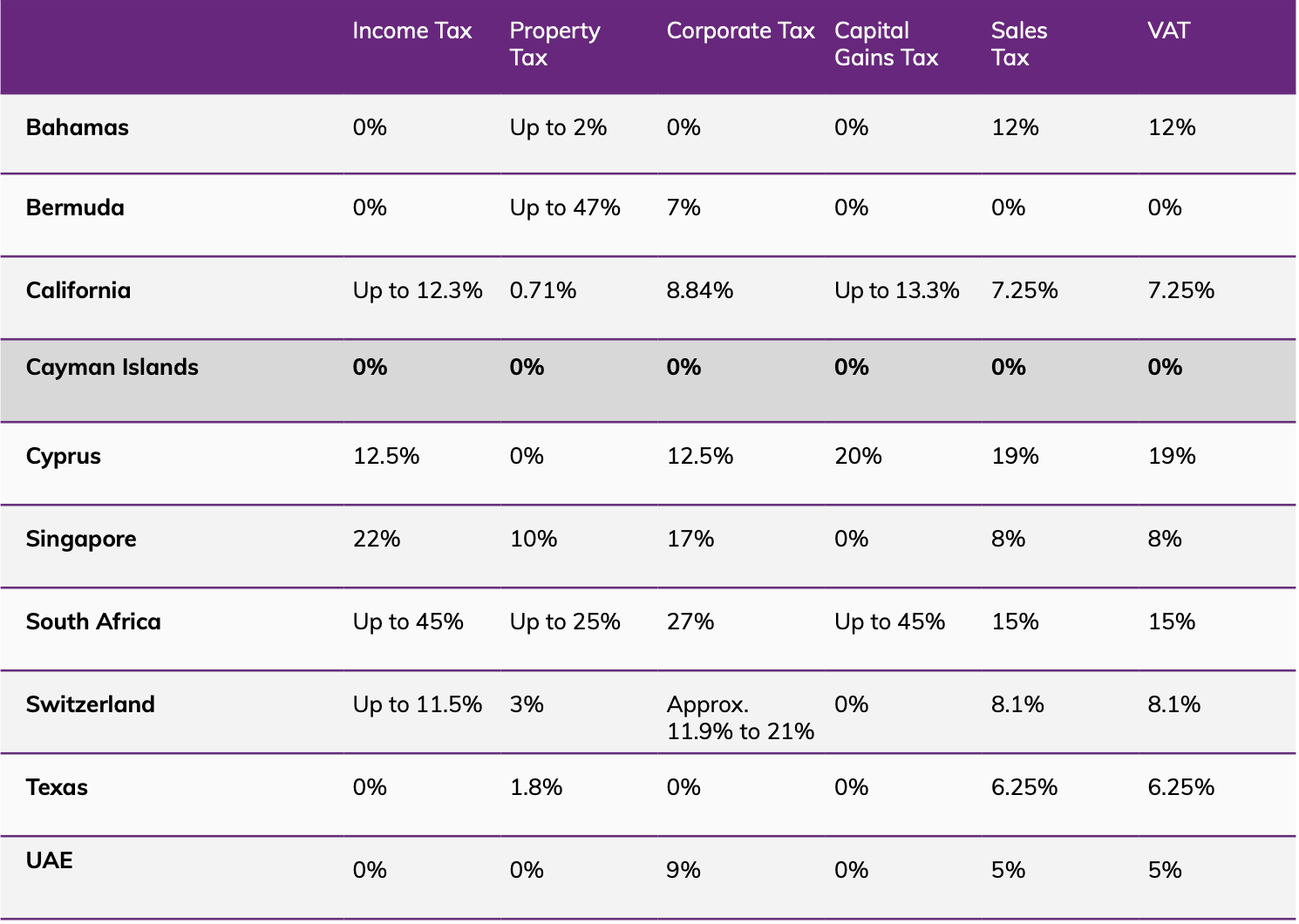

Establish your global business in the Cayman Islands and benefit from a 100% tax neutral environment.

The Cayman Islands has no personal income tax, local corporate tax or sales tax and the Cayman Enterprise City (CEC) tax-exempt special economic zone (SEZs) enables you to quickly and cost-effectively set up a genuine physical presence offshore.

Join a vibrant business community, position your business to become more profitable, and let our team of Global Mobility Experts take care of the details so you can focus on the big picture.

Meet others, like you, who have made the move and are operating a genuine offshore physical presence in the Cayman Islands with Cayman Enterprise City.

.jpg)

.png)

Offshore jurisdictions typically offer various tax incentives, including reduced or even eliminated taxes, translating to substantial financial savings for your company.

.png)

We sat down with Santosh Prasad and Ernie Nagratha from international tax advise company Trowbridge who shared their extensive expertise and experience in helping individuals and corporations to set up and operate abroad.

.png)

The Cayman Islands is one of the only jurisdictions to offer the benefits of a Special Economic Zone within a completely tax neutral environment.

There are no exit taxes, exchange controls, or penalties when leaving the jurisdiction.

The SEZ Act offers a fully transparent set of concessions that are written into Cayman Islands Law, and activity within the SEZ is regulated by a dedicated Government authority.

© Cayman Enterprise City. All rights reserved. T: +1 (345) 945-3722 E: info@caymanenterprisecity.com